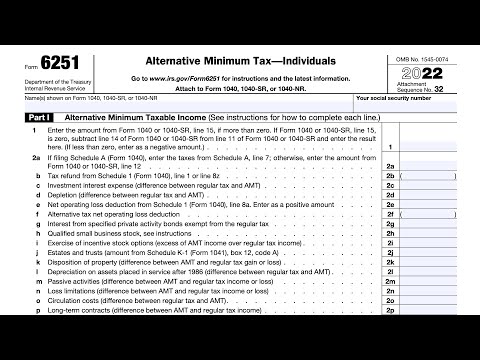

So we'll be reviewing IRS form 6251 Alternative Minimum Tax for individuals all taxpayers will be required to complete this form however all taxpayers are subject to testing to determine whether they have Alternative Minimum Tax so the purpose of form 6251 is to figure the amount if any of your Alternative Minimum Tax also known as AMT the AMT is a separate tax that is imposed in addition to your regular tax and it applies to taxpayers that have certain types of income which re receive favorable treatment or who qualify for certain deductions because these tax benefits can significantly reduce the regular tax AMT sets a limit on the amount of these benefits that can be used to reduce total tax in other words certain items of adjustment or deductions are calculated to help you determine what the alternative minimum tax amount should be people who must file IRS form 6251 include people who determine that line 7 is greater than line 10 and we will get to that momentarily people who claim any general business credit in either Line 6 in part one of form 3800 or line 25 of form 3800 is more than zero you also must file if you claim the qualified electric vehicle credit on IRS form 8834 the personal use of alternative fuel vehicle refueling property credit on form 8911 or if you have a credit for prior year minimum tax on form 8801 or if the total from form 6251 lines 2C through 3 are negative and line seven would be greater than line 10 if you did not account for these lines lines two C through 3. so we will go through each of these items of adjustment starting with part one it's important to note that this form actually...

PDF editing your way

Complete or edit your 2020 federal tax tables anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export 2019 federal tax tables directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your form 6251 2018 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your 2018 form 6251 by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

What you should know about Federal tax tables

- The AMT sets a limit on the amount of certain benefits that can reduce total tax.

- The tax benefits can significantly reduce the regular tax for some taxpayers with higher incomes.

- The AMT is a separate tax imposed in addition to the regular tax.

Award-winning PDF software

How to prepare Federal tax tables

About Form Instruction 6251

Form Instruction 6251 is a set of guidelines and explanations for completing Form 6251, which is the Alternative Minimum Tax (AMT) form used by taxpayers in the United States. The purpose of this form is to ensure that all taxpayers, especially those with high incomes or certain tax deductions, pay a minimum amount of tax. This instruction is primarily needed by individuals or households who meet certain criteria set by the Internal Revenue Service (IRS) and are subject to AMT. These criteria include having a high income level, claiming certain tax deductions, or having exercised incentive stock options. Taxpayers also need this instruction if they received any Tax Preference Items (TPI) or Adjustments ("Adjustments") applicable to AMT calculations. Form Instruction 6251 provides detailed explanations for each line on Form 6251 and helps taxpayers understand how to calculate their alternative minimum tax liability accurately. It serves as a reference to ensure compliance with AMT rules and regulations, and facilitates the accurate reporting of income, deductions, and AMT-related adjustments. It is essential for individuals or households who are potential candidates for the AMT to review and understand Form Instruction 6251 to properly calculate their tax liability and fulfill their payment obligations to the IRS.

How to complete a Federal tax tables

- Subtract line 3 from line 2

- If zero or less, enter 0

- Multiply line 4 by 25 0 = 25

- Enter this amount on Form 6251 line 5 and go to Form 6251 line 6

- The AMT sets a limit on the amount these benefits can be used to reduce total tax

- Also, use Form 6251 to figure your tentative minimum tax on Form 6251 line 9

- Use Form 6251 to figure the amount, if any, of your alternative minimum tax (AMT)

- You may need to determine if you can carry back or AMTFTC

- Also, the amount used to determine the phaseout of your exemption has AMT tax brackets

- For noncorporate taxpayers in 2022, the 26% tax rate applies to the first $206,100 ($103,050 if married filing separately) of taxable excess the amount on line

People also ask about Federal tax tables

What people say about us

How to fill out forms without having mistakes

Video instructions and help with filling out and completing Federal tax tables